What Counts As Income For An Estate . this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. On it, you'll report estate. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. the return is filed under the name and taxpayer identification number (tin) of the estate. “does inheritance count as income?” is a common question for beneficiaries. The form consists of three pages and requires basic. to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. Whether you personally will have to pay inheritance taxes will depend on several. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust.

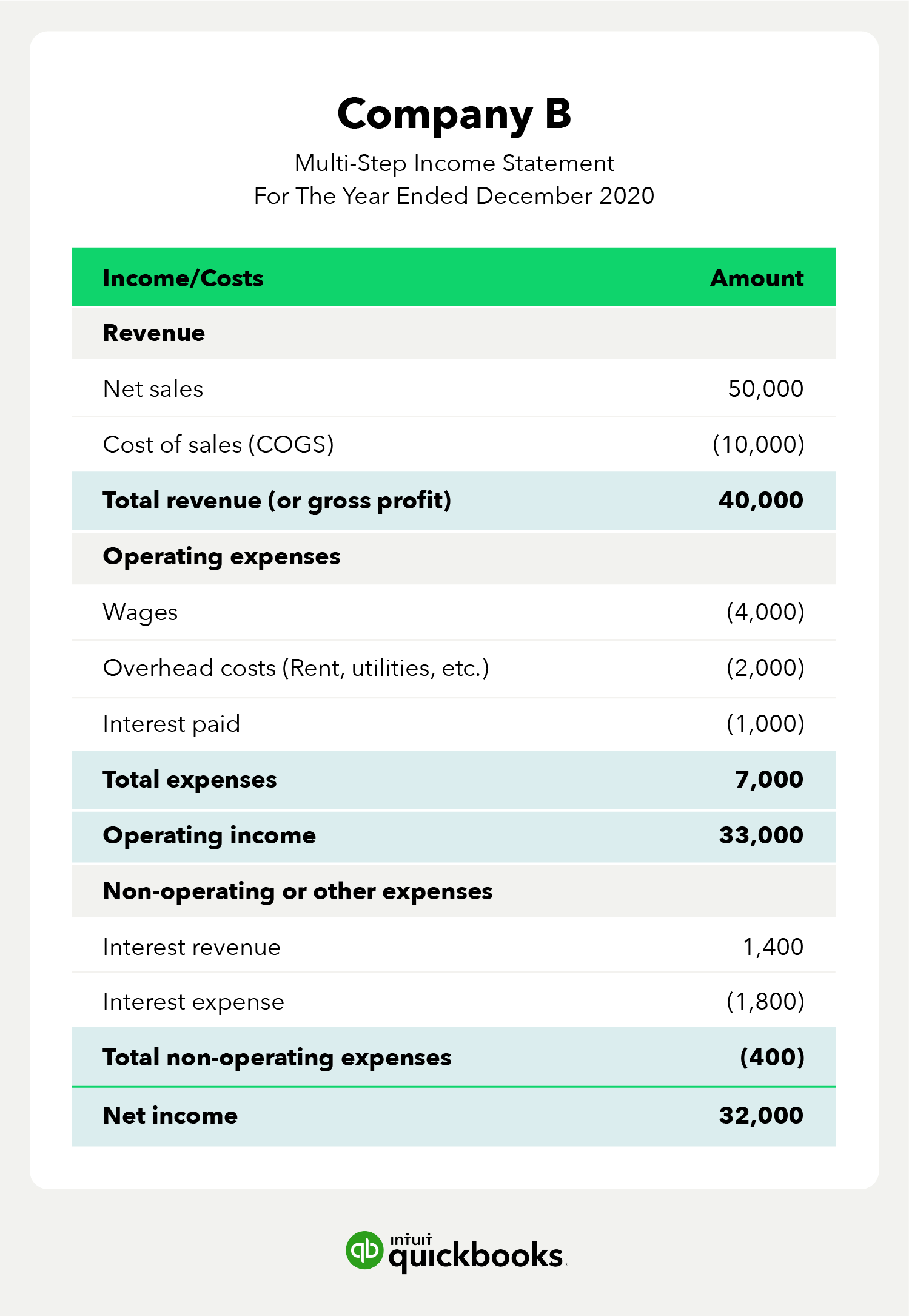

from quickbooks.intuit.com

Whether you personally will have to pay inheritance taxes will depend on several. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. the return is filed under the name and taxpayer identification number (tin) of the estate. On it, you'll report estate. “does inheritance count as income?” is a common question for beneficiaries. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. The form consists of three pages and requires basic.

statement Definition, preparation, and examples QuickBooks

What Counts As Income For An Estate On it, you'll report estate. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. The form consists of three pages and requires basic. the return is filed under the name and taxpayer identification number (tin) of the estate. “does inheritance count as income?” is a common question for beneficiaries. Whether you personally will have to pay inheritance taxes will depend on several. On it, you'll report estate. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long.

From www.slideserve.com

PPT PROPERTY ANALYSIS Introduction PowerPoint Presentation, free download ID5330138 What Counts As Income For An Estate “does inheritance count as income?” is a common question for beneficiaries. On it, you'll report estate. to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust.. What Counts As Income For An Estate.

From www.rentalvirtuoso.com

The Approach to Real Estate Appraisal How to Value Commercial and MultiFamily What Counts As Income For An Estate to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. the return is filed under the name and taxpayer identification number (tin) of the. What Counts As Income For An Estate.

From www.rocklandtrust.com

Your Guide to Navigating the Massachusetts State Estate Tax Law › Rockland Trust What Counts As Income For An Estate this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. to determine if an estate must file an income tax return, you must administer the decedent's estate. What Counts As Income For An Estate.

From www.crews.bank

Real Estate Prices vs. What Counts As Income For An Estate to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. Whether you personally will have to pay inheritance taxes will depend on several. the return is. What Counts As Income For An Estate.

From peoplesvoiceindia.blogspot.com

How to Calculate from House Property TIPS NEWS What Counts As Income For An Estate The form consists of three pages and requires basic. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. Whether you personally will have to pay inheritance taxes will depend on several. to determine if an estate must file an income tax return, you must administer the decedent's. What Counts As Income For An Estate.

From learn.roofstock.com

Rental Property Accounting 101 What Landlords Should Know What Counts As Income For An Estate Whether you personally will have to pay inheritance taxes will depend on several. the return is filed under the name and taxpayer identification number (tin) of the estate. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. form 1041 is an irs income tax. What Counts As Income For An Estate.

From www.mckissock.com

Top 10 States for Highest Real Estate What Counts As Income For An Estate the return is filed under the name and taxpayer identification number (tin) of the estate. “does inheritance count as income?” is a common question for beneficiaries. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. The form consists of three pages and requires basic. this. What Counts As Income For An Estate.

From www.slideserve.com

PPT PROPERTY ANALYSIS Introduction PowerPoint Presentation, free download ID5330138 What Counts As Income For An Estate On it, you'll report estate. The form consists of three pages and requires basic. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. to determine if. What Counts As Income For An Estate.

From resources.punchey.com

Understanding Your Statement Punchey Resources Howtoguides What Counts As Income For An Estate this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. The form consists of three pages and requires basic. form 1041 is an irs income. What Counts As Income For An Estate.

From propertymetrics.com

Effective Gross A Calculation Guide PropertyMetrics What Counts As Income For An Estate this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. The form consists of three pages and requires basic. On it, you'll report estate. form. What Counts As Income For An Estate.

From www.propertygeek.in

How To Calculate From House Property What Counts As Income For An Estate this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. Whether you personally will have to pay inheritance taxes will depend on several. the return is filed under the name and taxpayer identification number (tin) of the estate. On it, you'll report estate. The form consists. What Counts As Income For An Estate.

From www.slideserve.com

PPT PROPERTY ANALYSIS Introduction PowerPoint Presentation, free download ID5330138 What Counts As Income For An Estate On it, you'll report estate. the return is filed under the name and taxpayer identification number (tin) of the estate. “does inheritance count as income?” is a common question for beneficiaries. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. to determine if an estate. What Counts As Income For An Estate.

From www.youtube.com

Does inheritance count as Inheritance Tax, Estate Tax, Inherited IRA YouTube What Counts As Income For An Estate to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. “does inheritance count as income?” is a common question for beneficiaries. form 1041. What Counts As Income For An Estate.

From www.slideserve.com

PPT PROPERTY ANALYSIS Introduction PowerPoint Presentation, free download ID5330138 What Counts As Income For An Estate Whether you personally will have to pay inheritance taxes will depend on several. form 1041 is an irs income tax return filed by the trustee or representative of a decedent's estate or trust. “does inheritance count as income?” is a common question for beneficiaries. The form consists of three pages and requires basic. this interview will help. What Counts As Income For An Estate.

From templatelab.com

27 Statement Examples & Templates (Single/Multi step, Proforma) What Counts As Income For An Estate The form consists of three pages and requires basic. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. On it, you'll report estate. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. Whether you. What Counts As Income For An Estate.

From www.cainindia.org

How to maximise tax savings on your house property How to maximise tax savings on your What Counts As Income For An Estate the return is filed under the name and taxpayer identification number (tin) of the estate. On it, you'll report estate. to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. The form consists of three pages and requires basic. Whether you personally will have to pay inheritance. What Counts As Income For An Estate.

From www.appeconomyinsights.com

💡 How to Analyze an Statement What Counts As Income For An Estate On it, you'll report estate. this interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is. to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. form 1041 is an irs income tax return filed. What Counts As Income For An Estate.

From www.thesaascfo.com

Property Valuation Model A StepbyStep Guide The SaaS CFO What Counts As Income For An Estate The form consists of three pages and requires basic. this document explains in detail how to calculate and report income from dividends and interest, and it contains a long. On it, you'll report estate. to determine if an estate must file an income tax return, you must administer the decedent's estate with taxes in mind,. the return. What Counts As Income For An Estate.